Download your free PDF info-graphic here!

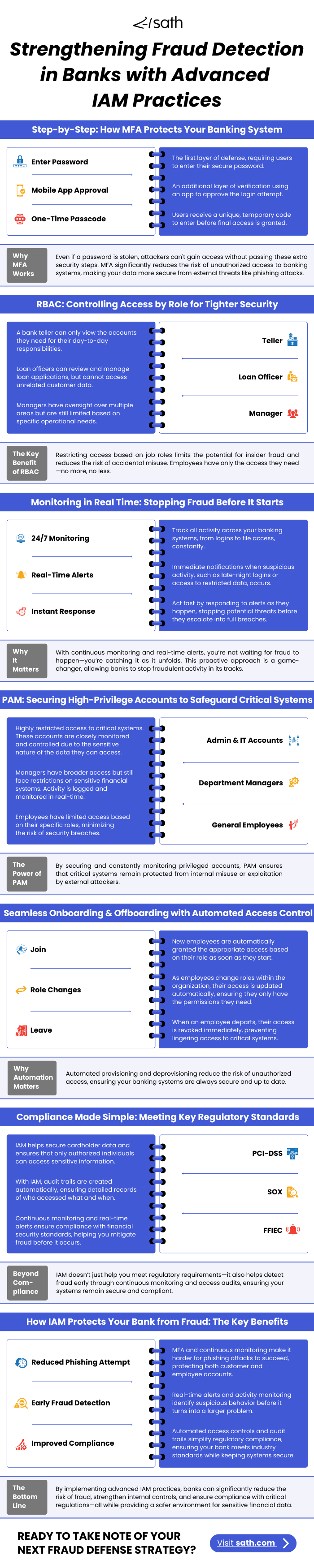

Strengthening fraud detection in banking is more critical than ever, and Identity and Access Management (IAM) practices provide a powerful solution.

Multi-factor authentication (MFA) enhances security by requiring multiple verification steps beyond just passwords, making it much harder for attackers to gain unauthorized access.

With role-based access control (RBAC), employees are only given access to the systems they need based on their job role, minimizing the risks of both external attacks and insider fraud.

These controls, combined with real-time monitoring and alerts, enable banks to detect and respond to threats quickly, preventing fraud before it escalates.

Privileged Access Management (PAM) secures high-level accounts with sensitive system access, while automated onboarding and offboarding ensure that only current employees have the necessary permissions.

IAM also simplifies compliance with regulations like PCI-DSS and SOX through automated audit trails and continuous monitoring.

Download our free info-graphic to learn more about how advanced IAM practices can help your bank strengthen fraud detection and improve compliance!