Regulations on Banks are just as ancient as Banks themselves, however they evolve constantly

Banks continue to face relentless regulatory scrutiny with uncoordinated rules, creating uncertainty and significant compliance risks, ultimately leading to increased challenges with managing security and compliance.

Kristina Schaefer, CRCM, CERP, and general counsel at First Bank and Trust, highlights the demands of regulations like the Community Reinvestment Act, Rule 1071, and CFPB requirements, which require substantial resources and expertise.

The Gramm–Leach–Bliley Act Section 1071 imposes strict reporting, data collection, and cybersecurity standards, particularly impacting small business lending. Additionally, the FFIEC and DORA enforce essential cybersecurity practices, and the proposed CISA rulemaking under the Cyber Incident Reporting for Critical Infrastructure Act of 2022 would broaden reporting obligations for significant cyber incidents and ransomware payments.

Implementing advanced Identity and Access Management (IAM) solutions can transform how financial institutions handle security, compliance, and operational efficiency. This post will teach you how IAM solutions enhance compliance and reporting accuracy, streamline access reviews, simplify workflows, improve security posture, and boost operational efficiency.

Read more about what the American Bankers Association recommends to mitigate security risk and help stay compliant.

Responsive Identity for Evolving Regulations

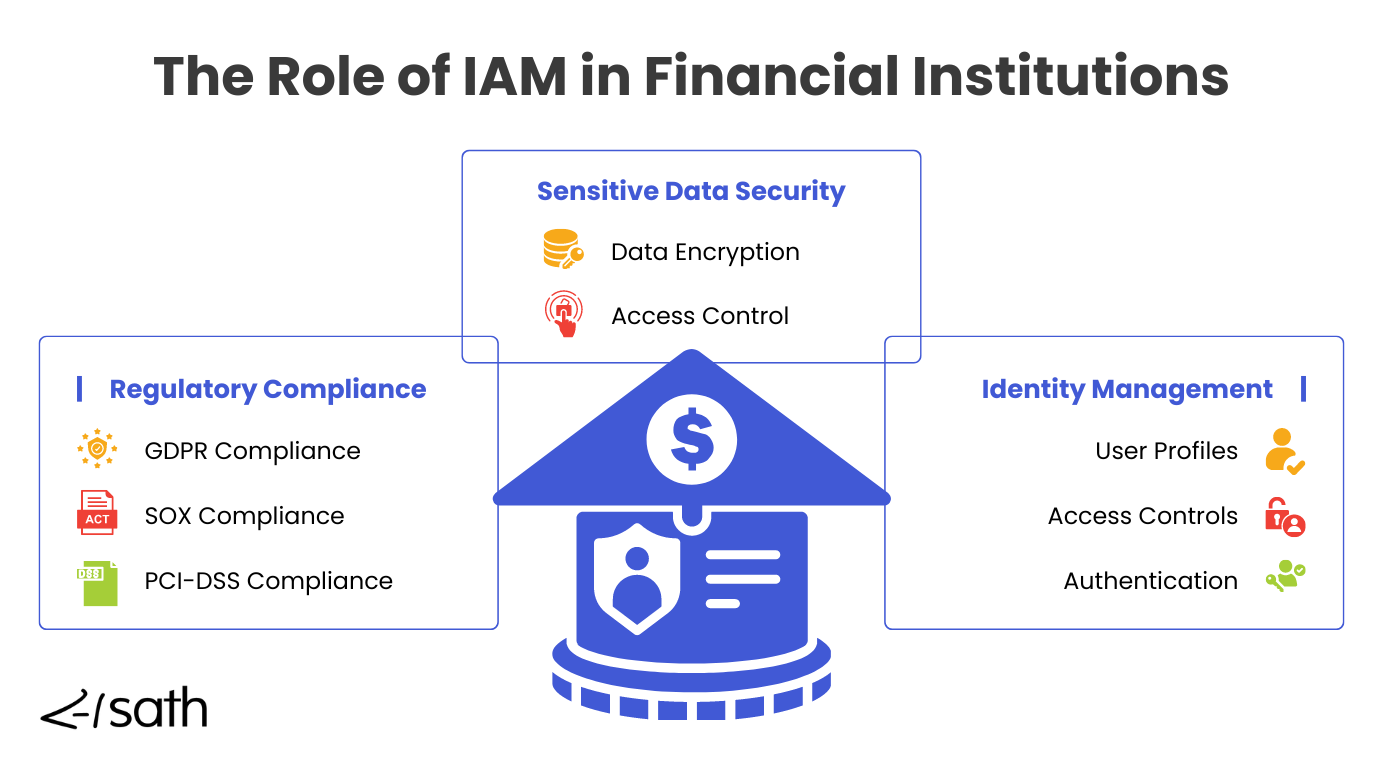

In financial institutions, keeping sensitive data safe is a top priority. Identity and Access Management (IAM) systems help ensure that only authorized individuals can access the necessary information. IAM solutions prevent unauthorized access and data breaches by managing user identities, passwords, and access permissions. They enhance security through effective data encryption, identity solutions and access control mechanisms.

Regulatory Compliance

Meeting regulations like GDPR, SOX, and PCI-DSS can be challenging for financial institutions. These rules require strict control over data access and protection. IAM systems make this easier by offering clear access controls and detailed reporting capabilities. This helps institutions stay compliant and avoid penalties.

These regulations demand detailed records of data access and user activity. IAM solutions simplify this by providing automated reporting and audit trails critical data used, making proving compliance to regulatory bodies easier.

Sensitive Data Security

IAM systems are essential for securing sensitive data. They use advanced data encryption and access control to protect critical financial information from unauthorized access and potential breaches. Continuous monitoring and management of access permissions ensure that only the right people can access sensitive data, greatly reducing the risk of data breaches.

Identity Management

Managing digital identities in a financial institution can be complex, but IAM systems streamline this task. Here’s how they help:

- User Profiles: IAM systems create and manage detailed user profiles, ensuring each user has the appropriate access permissions based on their role within the organization.

- Access Controls: They define and enforce who can access what, ensuring users only access the data and systems they need for their jobs.

- Authentication: Multi-factor authentication (MFA) adds an extra layer of security, requiring users to verify their identity through two or more methods, making it much harder for unauthorized users to gain access.

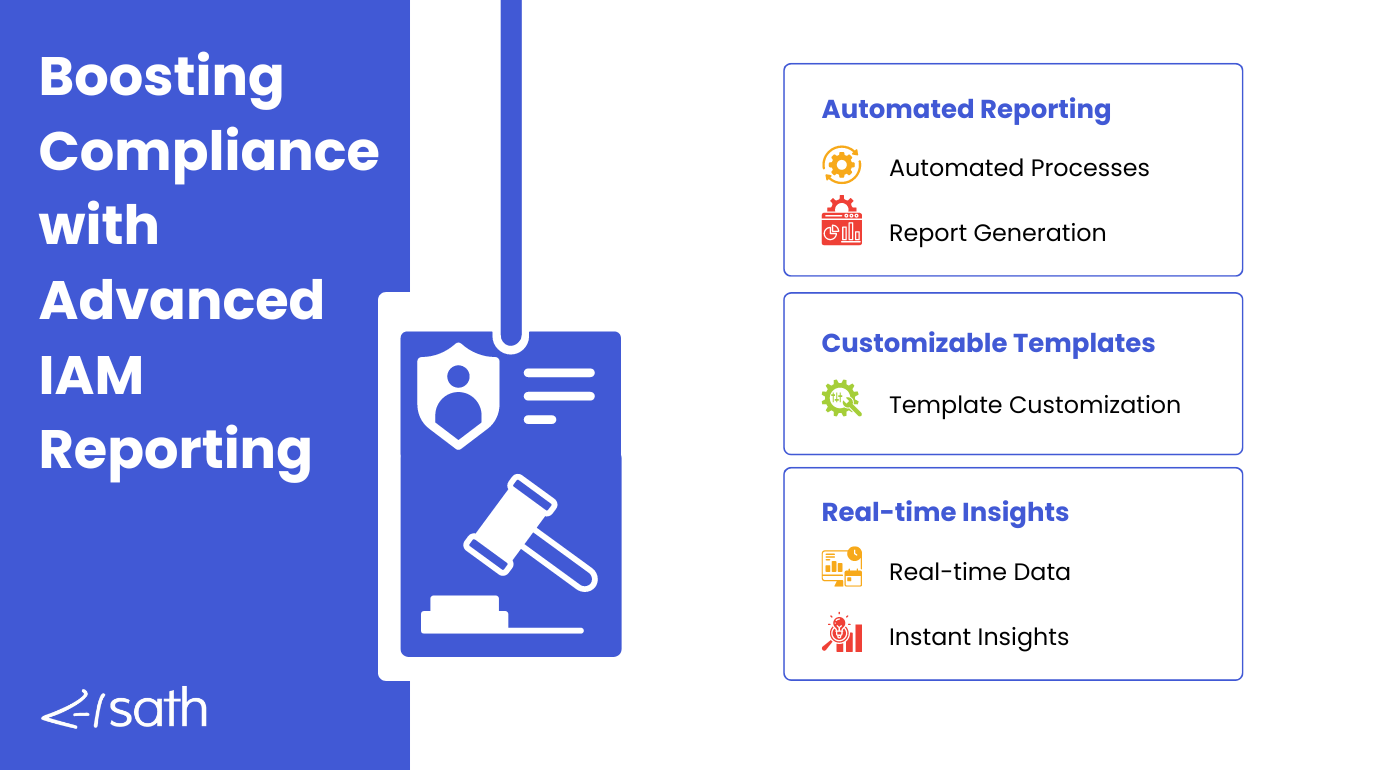

Enhancing Compliance Reporting with Financial IAM

Having strong visibility through accurate reporting and audit trails is crucial when it comes to staying compliant. IAM systems help financial institutions track user activities, access patterns, and potential security threats to sensitive systems. These reports provide a clear record of actions within the system, which is vital for internal reviews and audits.

Automated Reporting

Compliance reporting can be a hassle, but IAM systems make it easier with automated processes. They generate reports automatically, reducing the time and effort needed to compile data manually. This automation helps ensure that reports are accurate and readily accessible, meeting regulatory requirements without added stress.

Customizable Templates

IAM systems often come with customizable reporting templates, allowing institutions to tailor reports to their specific needs. These templates make it easier to organize and present data in a way that meets regulatory and finance industry standards and internal requirements.

For example, a financial institution might need to generate detailed reports on customers' access to sensitive financial data. With customizable templates, the institution can create a report highlighting who accessed the data, when, and from where, along with any unusual access patterns. This level of detail helps ensure transparency and compliance, making audits smoother and building trust with regulatory bodies and clients.

Real-Time Insights

One of the standout features of IAM systems is the ability to provide real-time data. Having access to real-time insights allows the financial sector and institutions to monitor activities as they happen. This immediate access to information enables quick responses to potential security threats and promptly addresses any unusual activities. Real-time data helps institutions avoid potential issues and maintain a strong security posture.

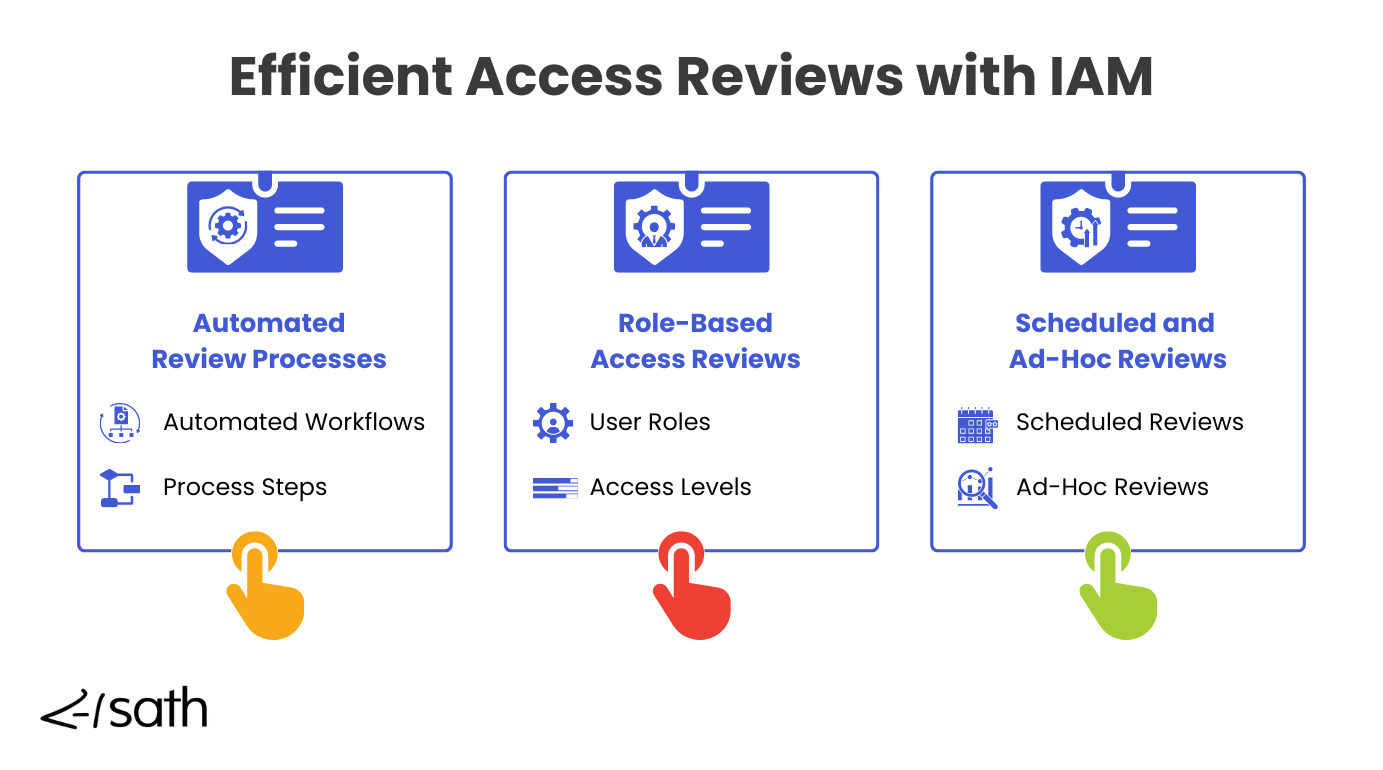

Streamlining Privileged Access Management Reviews

Conducting access management reviews can be a strenuous task, especially with the complexity of managing multiple users and systems in a serious business or financial institution. IAM systems can significantly ease this burden by simplifying and automating the review process, ensuring security and compliance are maintained efficiently.

Automated Management Reviews

Automated workflows in IAM systems can greatly streamline the review process, making it more organized and less time-consuming. By automatically initiating provisioning and managing access reviews, IAM systems save valuable time and reduce the risk of human error. This automation helps ensure that access reviews are conducted regularly and consistently, keeping access permissions up-to-date.

For example, a financial institution could set up an automated workflow to review access permissions for all employees at the end of each quarter. The IAM system would automatically send reminders, collect responses, and generate reports, allowing managers to identify risks and address discrepancies quickly. This would save time and ensure that access reviews are thorough and accurate.

Role-based Access Reviews

Using an IAM system allows for role-based access reviews, making managing and modifying access levels easier. Instead of reviewing each user individually, you can review and manage access permissions based on user roles. This approach simplifies the process by ensuring that permissions are appropriate for each role and can be easily adjusted as needed. Applying rules based on roles, IAM systems help maintain consistent and secure access controls.

Scheduled and Ad-hoc Reviews

Some financial industry compliance frameworks require regular reviews to be conducted at specific intervals. IAM systems can schedule these reviews automatically, ensuring they occur on time and meet regulatory requirements. This scheduled approach helps institutions stay compliant without manual tracking and reminders.

In addition to scheduled access reviews, IAM systems also support ad-hoc reviews. If a stakeholder needs immediate visibility on access permissions for privileged accounts, or if there is a sudden need to review access due to a security concern, an IAM system can provide this information quickly. This flexibility ensures that financial institutions can respond promptly to any access-related issues, maintaining transparency and security at all times.

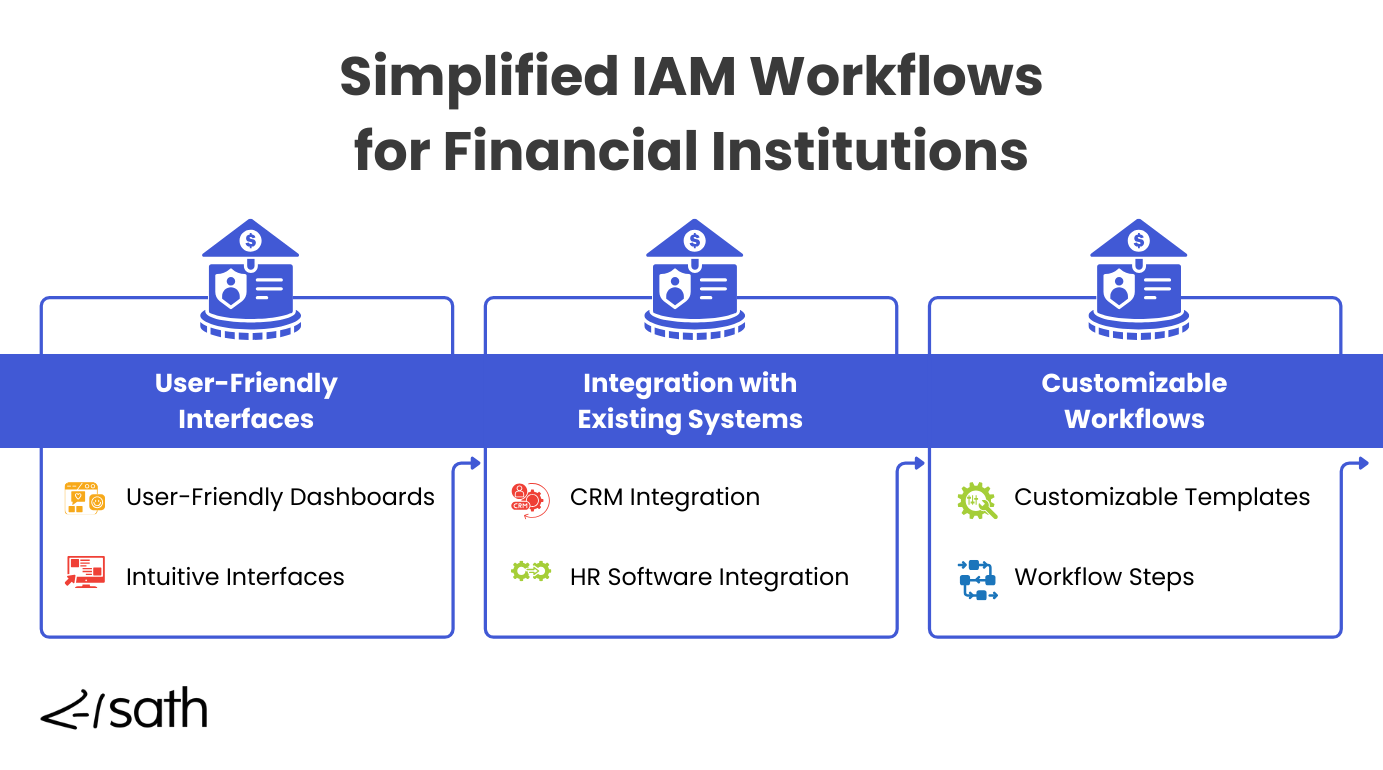

Simplifying Workflows with Financial IAM Solutions

Simplifying workflows helps financial institutions manage sensitive information securely and efficiently. IAM solutions for financial organizations ensure that only authorized individuals access specific information, preventing unauthorized access and data breaches and financial fraud. These solutions also aid regulatory compliance by monitoring and managing access rights.

User-Friendly Interfaces

An easy-to-use interface enhances visibility and customization for different stakeholders. Whether it's a customer, an IT manager, a compliance officer, or a department head, each user can access the specific information they need. This tailored visibility simplifies monitoring access rights and responding to issues promptly, making it easier for all stakeholders to perform their tasks efficiently.

Integrating with Existing Systems

IAM solutions can integrate seamlessly with existing systems, such legacy systems such as HR software and other enterprise applications. This integration ensures that user information is up-to-date and accurate across all platforms. For example, when employees join or leave the institution, their access rights can be automatically updated in the IAM system based on HR records, eliminating the need for manual updates and reducing the risk of errors.

A specific example for financial institutions could be integrating the IAM system with the bank's core banking software. This integration allows for real-time updates of user access rights based on changes in the bank or banking system, ensuring that access permissions are always current and aligned with the institution's needs.

Customizable Workflows

Customizable workflows in IAM systems help simplify processes by tailoring them to the institution's specific needs. This flexibility allows for creating workflows that match the institution's unique requirements, making daily tasks easier and more efficient for everyone involved. By adapting workflows to fit the institution's operations, IAM solutions ensure that security and compliance are maintained without unnecessary complexity.

Conclusion

In summary, IAM solutions offer significant benefits for financial institutions by enhancing finance compliance, reporting accuracy, making access reviews more efficient, simplifying workflows, improving security, and increasing operational efficiency. Incorporating IAM solutions into your strategy is essential for staying ahead of security threats and ensuring smooth operations.

Continue to Part 2 of this finance series: 5 IAM challenges in Finance and how IDHub solves them.

Ready to transform your institution's security, access governance and compliance processes? Contact us today to schedule a call and discover how our IAM solutions can meet your needs.